Indian Subsidiary Company Registration

Empowering Indian Entrepreneurs to Innovate and Grow

The Startup India initiative, launched by the Government of India, is designed to nurture and support startups across the country. By registering under Startup India, businesses can access a host of benefits including tax exemptions, funding support, easier compliance, and recognition. At Ruchita Dang & Associates, we assist entrepreneurs in getting their startup recognized under the DPIIT (Department for Promotion of Industry and Internal Trade), ensuring a smooth, fast, and compliant registration process.

What Sets Us Apart

500+ Professionals Network

5000+ All India Clients

2000+ Monthly Clients Onboarded

3500+ Trusted Ratings

What is Startup India Registration?

Startup India Registration is a government recognition process for eligible startups under the Startup India Scheme. Once recognized by DPIIT, startups gain legal identity and access to various incentives designed to ease business growth and attract investors.

Key Benefits of Startup India Recognition

- Income Tax Exemption for 3 consecutive years

- Capital Gains Tax Exemption

- Self-certification under labor and environmental laws

- Fast-tracked patent and trademark applications

- Easy access to government tenders

- Fund of Funds Scheme and other funding support

- No requirement of minimum capital

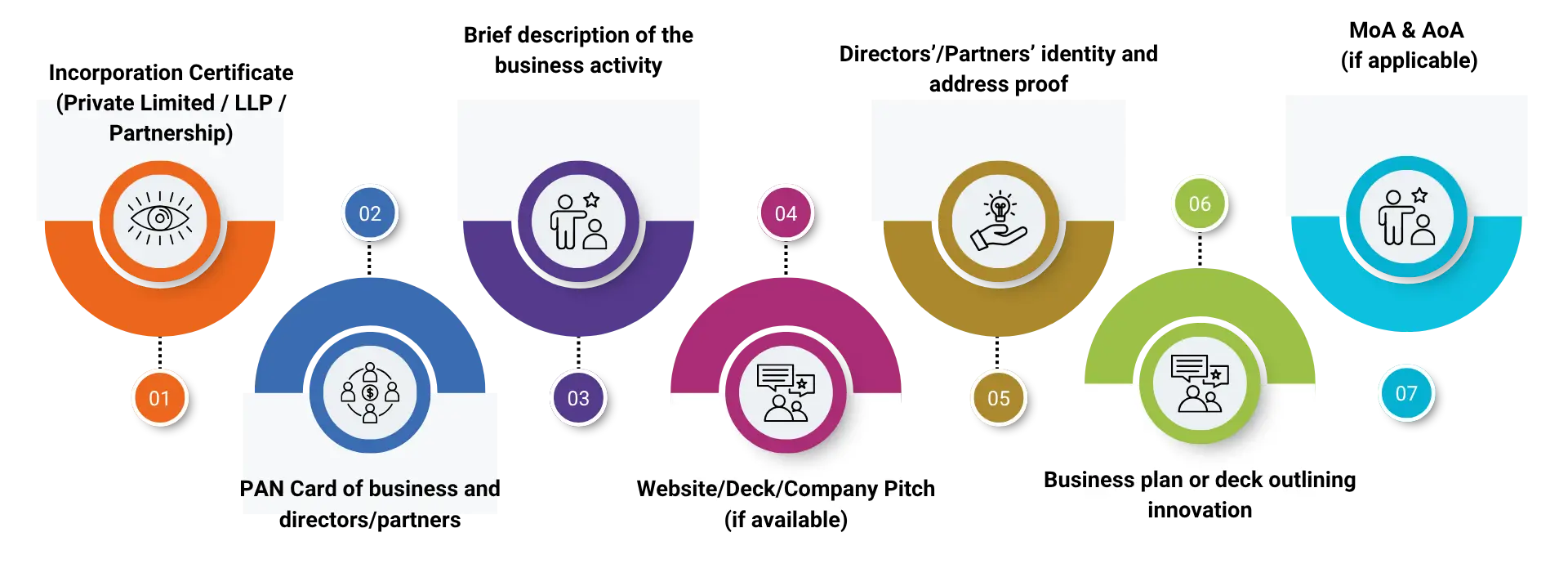

Documents Required for Startup

India Registration

Our Process – How Ruchita Dang & Associates Helps You

Step 1

Step 2

Step 3

Step 4

Step 5

Why Ruchita Dang & Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

Frequently Asked Questions

An Indian Subsidiary Company denotes a company that is established in India and is in some way under the control or ownership of a foreign company. It not only facilitates the international companies to have a legal foothold in India but also gives them the advantages of limited liability and full operating rights as per the Companies Act, 2013.

Foreign companies must appoint at least two directors (one must reside in India), select a corporate name, and file the incorporation papers on the MCA (Ministry of Corporate Affairs) portal to obtain Indian Subsidiary Company Registration. Using the services of the specialists in Indian Subsidiary Company Registration, the foreign company can make sure of following the regulations throughout the process.

The documents consist of the incorporation certificate of the parent company, a board’s resolution, a registered office in India, PAN and passport copies of directors, and digital signature certificates. Getting the help of a skilled Indian Subsidiary Company Registration Consultant will ensure that these documents are properly prepared and filed.

The main benefits are full foreign ownership (in almost all areas), limited liability, trouble-free business extension to India, and the Indian consumer market which is quite large as a customer base. The process to get Indian Subsidiary Company Registration is made smoother and legally compliant due to the services of the experts.

Generally, it takes approximately 15 to 20 working days for an Indian Subsidiary Company Registration to be completed. This duration is dependent on the speed of documentation and approval. A professional Indian Subsidiary Company Registration Consultant can be of help in speeding up the process and ensuring

After meeting the requirements of Indian tax legislation and FEMA (Foreign Exchange Management Act) rules, the profits and dividends can be sent back to the parent company. Trustworthy Indian Subsidiary Company Registration Services facilitate firms in navigating all compliance procedures.

The services of a professional Indian Subsidiary Company Registration Consultant can help eliminate the whole process of setting up the company, ensuring that it meets all Indian corporate law requirements, managing the documentation, and overseeing the post-incorporation formalities so that the operations in India can be smooth.