Section 8 Company Registration

Looking for Section 8 Company Registration in India? At Ruchita Dang & Associates we provide full support throughout the Section 8 Company Registration Process

- 2 DIN and DSC

- Drafting of MoA & AoA

- Government Stamp duty

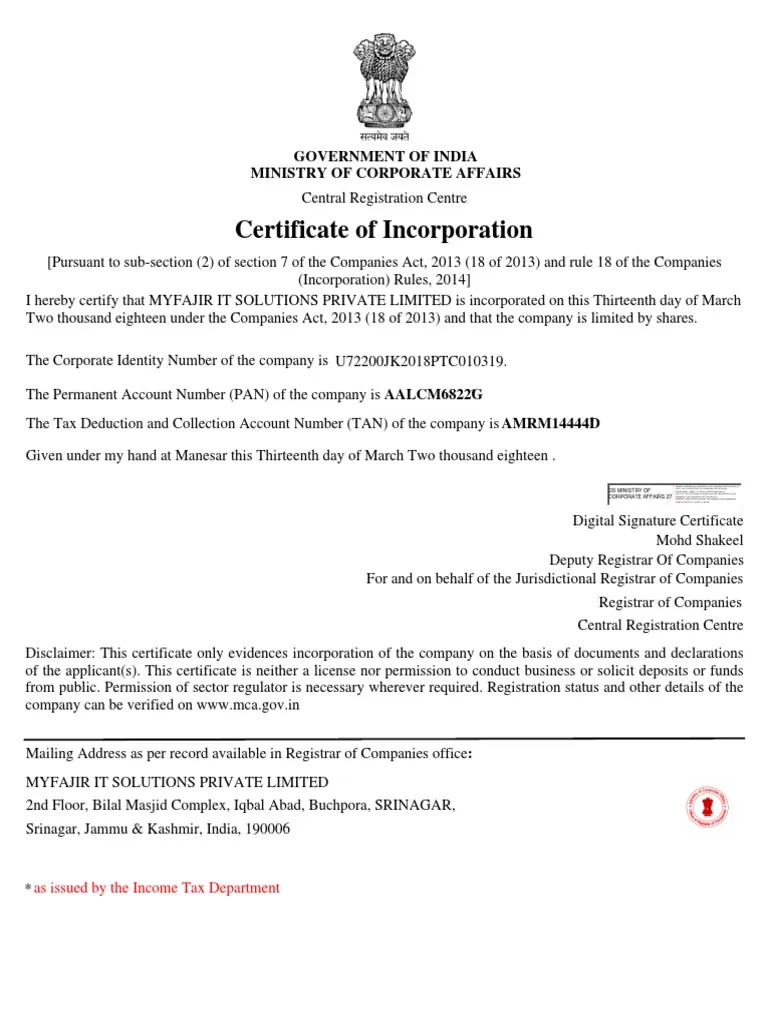

- Company Incorporation Certificate

- Company PAN and TAN

- ZohoBooks subscription

- Certificate of commencement of busines

- Section 8 approval letter

Submit your Details to get an Instant All-inclusive Quote to your email and a FREE Expert consultation

An Overview of Section 8 Company Registration

In India, a Section 8 Company functions as an NGO dedicated to advancing various fields such as art, science, education, sports, and charitable activities. Unlike Trusts or Societies, profits generated by Section 8 Companies are reinvested to support their stated objectives rather than being distributed to company members. The registration process for a Section 8 Company falls under the jurisdiction of the Ministry of Corporate Affairs (MCA), distinguishing it from Trusts and Societies, which are governed by State Government Registrars.

Advantages of Section 8 Company

Registration in India

Following are the advantages of Section 8 Company Registration in India:

1. Separate Legal Entity:

2. More Trustworthy & Credibility:

3. Nil Stamp Duty:

4. Minimum Share Capital:

5. No Minimum Capital is Required:

In India, Section 8 Companies do not have a minimum capital requirement and they can adjust their capital structure as per their growth and give them more flexibility.

6. Exemption to Donors:

Important Points Regarding Section 8 Company in India

Following are some vital points about Section 8 Company in India:

- NGOs in India can be registered under Registrar of Societies or as a Non-Profit entity under Section 8 Company of the Companies Act, 2013

- Compliance with Companies Act is compulsory for Section 8 Company, including Filing returns with the ROCs, maintaining books of accounts, & complying with GST and IT Act Regulations

- Section 8 Company in India cannot utilise profits for purposes other than charitable objectives & cannot distribute them among shareholders of the Company

- Any alterations to the Charter Documents like AoA & MOA require consent from the Government

- Section 8 Companies are identical to the former Section 25 Companies Under the Companies Act 1956 and now, they are recognized as such under the prevailing legislation

Eligibility Criteria for Section 8 Company

Registration in India

Following is the eligibility criteria for Section 8 Company Registration in India:

- At least 1 Director is required and he or she should be a resident of India

- HUF, an individual is eligible to commence a Section 8 Company in India

- The objective of the Company should be one or more of the following – the advancement of science & art, social welfare, promotion of sports/arts, and financial support to lower-income groups

- 2 or more individuals who will act as Directors/Shareholders should fulfill all the compliance & requirements of the Section 8 Company Registration under the Companies Act

- Directors, founders, and Members Directors of the Company cannot draw any remuneration in any form of cash or kind

- No profit should be shared or distributed among the Directors & members of the Company indirectly/directly

Why Ruchita Dang & Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

FAQs on Section 8 Company Registration

A Section 8 Company is an NPO that is registered under the Companies Act, 2013 and whose aim is to enhance social welfare, education, charity, and environment protection among others. Unlike regular companies, it uses its profits solely for the purpose of its objectives.

To obtain Section 8 Company Registration you must first obtain a license from the Registrar of Companies (ROC), then submit incorporation documents and finally get approval from the Ministry of Corporate Affairs (MCA). Professional Section 8 Company Registration Services will guide you through the smooth and compliant registration process.

The main benefits include tax exemptions, credibility, grants from the government, liability limited to the amount invested, and permanent succession. Expert Section 8 Company Registration Services will help your organization to take advantage of them while still being compliant with Indian laws.

The most important documents are PAN and Aadhaar of the directors, proof of the office address, digital signature certificates (DSC), and a full declaration of the company’s charity objectives. A Section 8 Company Registration Consultant will help you get all the documents needed accurately prepared and filed.

The process of Section 8 Company Registration generally takes about 15–25 working days, depending on government approvals and the accuracy of the documentation. Choosing a Section 8 Company Registration Consultant means quicker approvals and submission without errors.

Indeed, a Section 8 Company can generate income, but the revenue will have to be used exclusively for the intended purposes of charity or social work and not shared among the members. Section 8 Company Registration Services help NGOs and social enterprises to keep this rule in compliance.

An experienced Section 8 Company Registration Consultant takes care of all legal matters, makes license applications, and maintains documentation while also keeping the firm compliant with both MCA and income tax rules.