Public Limited Company Registration in India

Get Your Business Listed and Scale with Confidence

A Public Limited Company (PLC) is a corporate entity that can raise capital from the public through the stock exchange. It is ideal for large-scale businesses that plan to expand rapidly or seek funding from investors and the general public. At Ruchita Dang & Associates, we simplify the process of registering your Public Limited Company, ensuring you meet all legal and regulatory requirements.

What Sets Us Apart

500+ Professionals Network

5000+ All India Clients

2000+ Monthly Clients Onboarded

3500+ Trusted Ratings

What is Public Limited Company Registration?

Public Limited Company Registration is the legal process of incorporating a business entity that can offer its shares to the general public and raise capital from investors. A Public Limited Company (PLC) operates under the provisions of the Companies Act, 2013 and is governed by the Ministry of Corporate Affairs (MCA) in India.

This type of company is ideal for large-scale businesses that plan to expand operations, list on stock exchanges, or attract large investments. A Public Limited Company enjoys limited liability, perpetual succession, and has a separate legal identity from its shareholders and directors.

Why Choose a Public Limited

Company?

- Access to Capital: Raise funds from the public through shares.

- Enhanced Credibility: Gain trust with shareholders, customers, and investors.

- Separate Legal Entity: Protects personal assets of shareholders.

- Transferability of Shares: Shares can be easily transferred.

- Limited Liability: Shareholders' liability is limited to their investment.

Submit your Details to get an Instant All-inclusive Quote to your email and a FREE Expert consultation

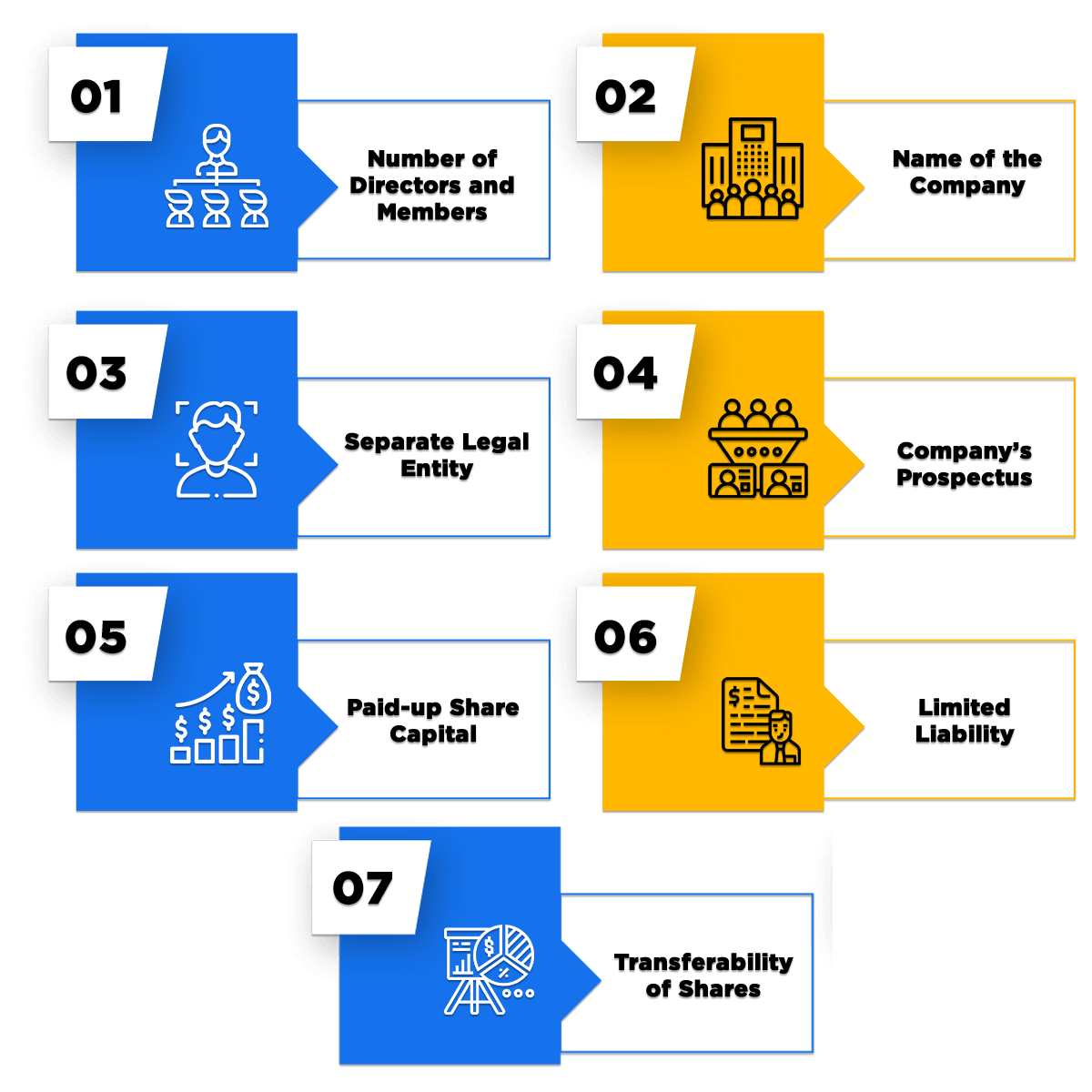

Requirements for Public Limited Company Registration

- Minimum 7 shareholders and 3 directors

- A registered office address in India

- Digital Signature Certificate (DSC) and Director Identification Number (DIN)

- PAN and Aadhaar of all directors/shareholders

- Memorandum of Association (MoA) and Articles of Association (AoA)

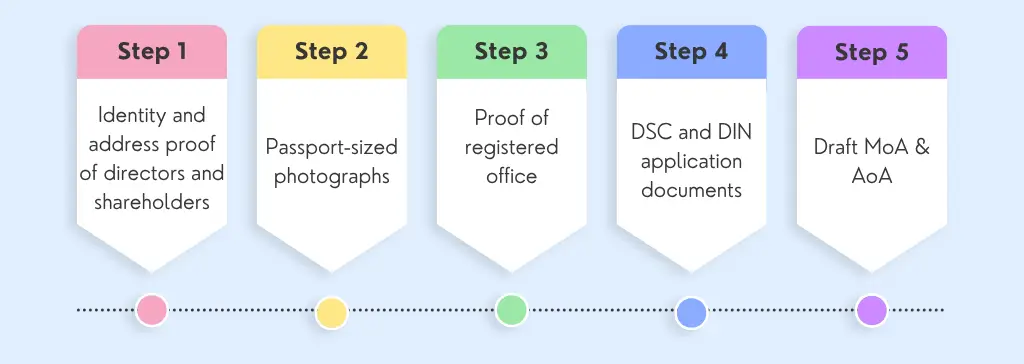

Documents Required

- Identity and address proof of directors and shareholders

- Passport-sized photographs

- Proof of registered office (utility bill + NOC)

- DSC and DIN application documents

- Draft MoA & AoA

Public Limited Company Registration Process

Step 1

Step 2

It acts as a unique identification number for directors.

Step 3

MCA will approve the name if it’s unique and not similar to existing companies.

Step 4

MOA defines company objectives; AOA governs internal rules and management.

Step 5

Attach supporting documents (identity/address proof, NOC, etc.).

Step 6

Mandatory for tax and compliance after incorporation.

Step 7

Includes CIN, PAN, TAN, and official registration of the company.

Step 8

Why Ruchita Dang & Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

Frequently Asked Questions

A Public Limited Company is a business entity which goes public by offering its shares to the people and it is registered under the Companies Act of 2013. It limits the liability of its shareholders and is therefore an excellent choice for big businesses that want to raise capital through public offerings.

The application has to be made with the Ministry of Corporate Affairs (MCA) through the SPICe+ portal, along with the submission of the requisite documents and the obtaining of various approvals such as the Certificate of Incorporation, to complete the registration of a Public Limited Company. A lot of businesses like to hire Public Limited Company Registration Services to help them with the registration process as it is smooth and error-free.

The minimum requirements for a Public Limited Company include having a board of 3 directors, at least 7 shareholders, and minimum authorized capital as determined by the government. A skilled Public Limited Company Registration Consultant can guide you through the process of meeting these requirements and submitting the forms correctly.

The primary advantages are the capacity to accumulate funds by way of public shares, greater reputation, the status of a separate legal entity, and the protection of limited liability. By taking advantage of professional Public Limited Company Registration Services, you can be assured that all compliance measures are in place and that you will enjoy the benefits.

Generally, it takes about 10 to 15 working days to complete the whole procedure, but the time may vary subject to the document verification process and MCA approvals. A professional Public Limited Company Registration Consultant will help in speeding up the whole process by making sure that every detail is accurate.

Identity and address proof of all the shareholders and directors, proof the registered office address, Digital Signature Certificates (DSC), and the Memorandum and Articles of Association are all required. The preparation and filing of all these documents are taken care of by expert Public Limited Company Registration Services.

The answer is yes, a Private Limited Company can be converted into a Public Limited Company by following the steps prescribed by the MCA. Thus, a trusted Public Limited Company Registration Consultant can take care of documentation, resolutions, and filing requirements thus making the conversion smooth.