Private Limited Company Registration

Looking to get your Private Limited Company registered? You're in the right place!

At Ruchita Dang & Associates, we simplify the entire Pvt. Ltd. Company registration process into a few seamless online steps. Say goodbye to paperwork hassles and let our team of experts take care of the formalities—accurately and efficiently.

At Ruchita Dang & Associates, We Register, YOU GROW! Don't wait—Start your Private Limited Company today!

What is a Private Limited Company Registration?

A private limited company registration is one of the most popular and trusted forms of business structure in India. It is ideal for startups, small businesses, and enterprises seeking limited liability and separate legal identities.

Incorporating as a private limited company offers a range of advantages, such as a clear separation between personal and business finances, enhanced credibility, and easier access to funding and investments.

This combination of legal protection, operational flexibility, and financial discipline makes the private limited company a preferred choice in India’s dynamic and competitive market. Combine that with Ruchita Dang & Associates’ expert assistance and cost-friendly pricing, and you are set.

Submit your Details to get an Instant All-inclusive Quote to your email and a FREE Expert consultation

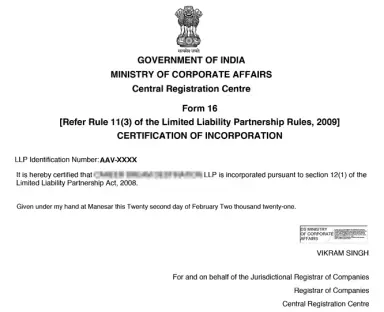

Private Limited Company Registration Certificate.

Characteristics of a Private Limited

Company in India

To understand whether registering your company as a private limited would be ideal or not, check out these characteristics:

- Separate Legal Entity

A Private Limited Company has a distinct legal identity, separate from its owners and shareholders. This means:

- The company can own property, incur debts, sue, or be sued in its name.

- Shareholders and directors are not personally liable for the company's obligations.

- Limited Liability

The liability of shareholders is limited to the unpaid amount on their shares. Basically:

- Personal assets of shareholders are safeguarded from business losses or debts.

- In case of bankruptcy, shareholders only lose their invested capital.

- Minimum and Maximum Members

A Private Limited Company must have a minimum of 2 and a maximum of 200 members (excluding employees and former employees holding shares).

- This makes it suitable for closely held businesses or family-owned enterprises.

- Share Capital

The company must have a minimum authorized share capital of INR 1,00,000 (this can be increased as required). As for paid-up capital, the Companies Act, 2013 no longer mandates a minimum paid-up capital for Private Limited Companies.

- Shareholders contribute capital by purchasing shares, and their liability is capped to their investment amount.

- Restriction on Share Transfer

Shares in a Private Limited Company are not transferable to prevent hostile takeovers. Shareholders need the approval of other members to transfer shares, ensuring control remains within a trusted group.

- Restriction on Share Transfer

Shares in a Private Limited Company are not transferable to prevent hostile takeovers. Shareholders need the approval of other members to transfer shares, ensuring control remains within a trusted group.

- Shareholders contribute capital by purchasing shares, and their liability is capped to their investment amount.

What are the Advantages of a Private Limited

Company Registration?

Registering as a Private Limited Company offers several key benefits that make it a popular choice for entrepreneurs and business owners in India.

Protection of Personal Assets

A private limited company ensures that shareholders have limited liability. This means their personal assets are safeguarded against any debts or losses incurred by the business.

Investment Protection

Shareholders are only responsible for the company’s liabilities up to the amount they have invested, providing a critical safety net for individuals.

Distinct from Owners

Once registered, a private limited company becomes a separate legal entity, independent of its directors and shareholders. This separation means that the company itself is responsible for managing its assets, liabilities, and obligations.

Business Operations

Shareholders and directors cannot be held personally accountable for the company’s financial losses, ensuring a clear boundary between personal and business responsibilities.

Funds and Investments

Private limited companies are an attractive option for raising funds. Their structured nature and credibility make it easier to attract equity investment from venture capitalists, angel investors, and other funding sources. This structure supports growth and expansion while keeping personal financial risk to a minimum.

Financial Growth

Appealing for raising funds due to their structured nature and credibility, attracting equity investment from venture capitalists and angel investors. This setup fosters growth while minimizing personal financial risk.

Reliable Platform

Being registered under the Companies Act and governed by regulatory bodies adds credibility to a private limited company. Prospective clients, investors, and partners can verify its details through official government platforms, creating a sense of trust.

Business Reliability

It demonstrates a commitment to professional business practices and regulatory compliance, building trust with stakeholders.

Uninterrupted Existence

Unlike sole proprietorships or partnerships, a private limited company enjoys perpetual succession. This means the company continues to exist regardless of changes in ownership, such as the death or resignation of directors or shareholders. The continuity ensures long-term stability and reliability.

Transferability of Shares

Private limited companies offer ease of ownership transfer through the sale or transfer of shares. It ensures that ownership can be passed on to others without disrupting the company’s operations. This flexibility in ownership transfer is advantageous for business growth and succession planning.

#1 company Registration Consultant in India

+91-9250561216

For More Details Contact Us Now!

FAQs on Private Limited Company Registration

A Private Limited Company Registration Consultant is a professional who offers assistance to new business owners in officially registering their company according to the Companies Act, 2013. They are responsible for documentation, compliance, and submission to the Ministry of Corporate Affairs (MCA).

Consultation with an expert guarantees that your application is completed correctly, all the documents validated correctly, and you do not face any delays or refusals. Trustworthy Private Limited Company Registration Services provide a seamless and trouble-free process for the whole registration.

Identity proof, address proof, passport-size photographs of directors, proof of registered office address, and digital signature certificates (DSC) are the documents needed. A Private Limited Company Registration Consultant confirms that all documents conform to MCA standards.

The registration process takes 7–10 working days for complete documents. Professional Private Limited Company Registration Services can expedite approvals.

It grants limited liability, separate legal identity, easier fundraising, and better business reputation. A Private Limited Company Registration Consultant will elaborate on these advantages and assist you with incorporation.

Indeed, online registration is possible through the MCA portal. Nevertheless, a lot of startups choose to use Private Limited Company Registration Services to eliminate mistakes, maintain compliance, and save time.

At least two and not more than fifteen directors are necessary. Your Private Limited Company Registration Consultant will assist you in appointing qualified directors and obtaining the Director Identification Number (DIN).

The fee is influenced by aspects such as government charges, professional fees, and authorized capital. Engaging Private Limited Company Registration Services affords cost transparency and guarantees value for money.

It is possible to convert a Private Limited Company into an LLP or Public Limited Company by adhering to the guidelines set by the MCA. A knowledgeable consultant for Private Limited Company registration will handle the legal paperwork and the compliance part during the transition process.