Partnership Firm Registration

Looking to start a business with a trusted partner? Registering a Partnership Firm is one of the simplest and most cost-effective ways to begin your entrepreneurial journey in India. At Ruchita Dang & Associates, we make Partnership Firm Registration easy, quick, and compliant—helping you build a solid foundation for your business collaboration.

- Procedure for Partnership Firm Registration.

- Partnership Agreement & Deed Drafting Services.

- Getting Deed Number for the Partnership.

- Obtaining the PAN Number of the partnership.

- End-to-end Support

What Sets Us Apart

500+ Professionals Network

5000+ All India Clients

2000+ Monthly Clients Onboarded

3500+ Trusted Ratings

What is a Partnership Firm?

A Partnership Firm is a type of business structure where two or more individuals come together to run a business with shared responsibilities, profits, and losses as outlined in a Partnership Deed. It is governed by the Indian Partnership Act, 1932.

Types of Partnership Firms

- Registered Partnership Firm: Registered with the Registrar of Firms for legal recognition and enforceability.

- Unregistered Partnership Firm: Operates legally but has limited rights in legal disputes.

Benefits of Registering a Partnership Firm

- Easy and affordable registration

- Minimal compliance compared to other business structures

- Shared decision-making and risk

- Flexibility in business operations

- No requirement for minimum capital

Submit your Details to get an Instant All-inclusive Quote to your email and a FREE Expert consultation

Our Process

Step 1

Step 2

Step 3

Step 4

Step 5

Why Ruchita Dang &

Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

Frequently Asked Questions

A Partnership Firm is a type of business organization in which two or more persons have come together to share the profits and losses of a business carried on jointly. It is regulated by the Indian Partnership Act of 1932 and is an ideal form of business for small and medium-sized enterprises as it gives them the necessary convenience and low-cost setup.

The process of Partnership Firm Registration comprises the making of a Partnership Deed, the signing of the same by all the partners, and finally, the submission of the signed Partnership Deed to the Registrar of Firms in your state. Many startups choose to enlist the support of professionals for Partnership Firm Registration in order to avoid mistakes during the process.

The registration of a partnership firm is not a legal requirement, but it is strongly recommended. A registered dealing can sue third parties and partners, while an unregistered one cannot. A Partnership Firm Registration Consultant will elucidate these legal advantages in detail.

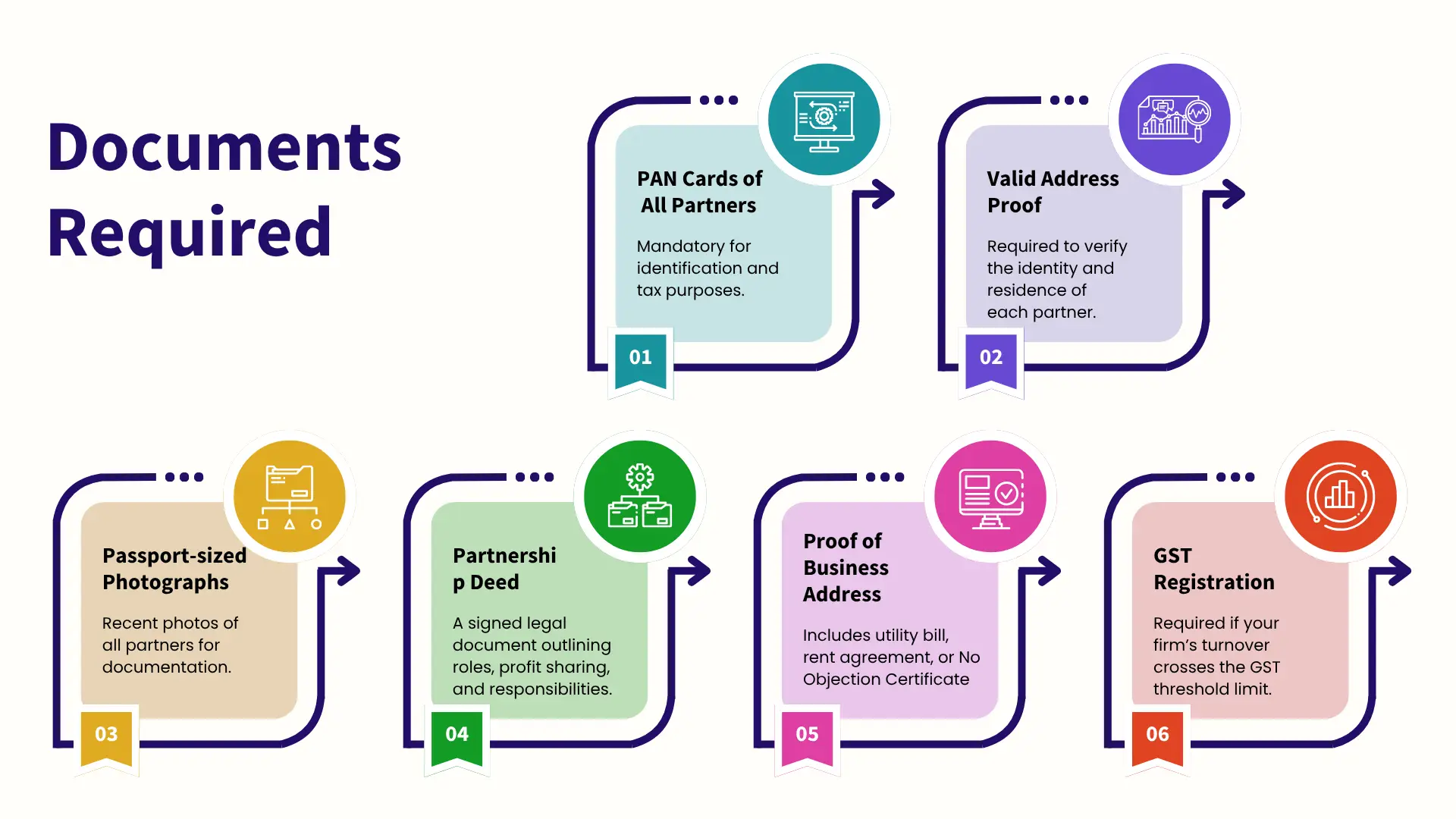

Partnership Deed, proof of address of the firm and partners, PAN cards, and photographs are the main documents. Professional Partnership Firm Registration Services make sure that every document is thoroughly checked for correctness and submitted to the Registrar.

The primary advantages of Partnership Firm Registration are including legal approval, easier access to funds, increased goodwill, and security of the partners’ rights. It also facilitates the opening of bank accounts and obtaining of licenses in the name of the firm.

Registration of partnership firm generally takes about 7 to 10 working days but it may vary depending on document vetting and getting the Registrar of Firms’ approval. If you hire a consultant for partnership firm registration, the process can be made faster.

A Partnership Firm can indeed be transformed into an LLP (Limited Liability Partnership) or a Private Limited Company, if its needs are that of a large-scale operation. You can count on the professional Partnership Firm Registration Services to guide you through and take care of everything for the legal conversion and paperwork.