MSME Registration

Empower Your Business with MSME Benefits

Looking to register your Micro, Small, or Medium Enterprise? You've come to the right place! At Ruchita Dang & Associates, we make MSME (Udyam) Registration easy, fast, and completely online. Our expert-assisted service ensures your business gets legally recognized under the Ministry of MSME and gains access to various government benefits.

What Sets Us Apart

500+ Professionals Network

5000+ All India Clients

2000+ Monthly Clients Onboarded

3500+ Trusted Ratings

What is MSME (Udyam) Registration?

MSME Registration, now known as Udyam Registration, is a government-issued recognition for Micro, Small, and Medium Enterprises in India. It is completely paperless and based on self-declaration. Once registered, your business becomes eligible for a wide range of benefits offered under the MSMED Act.

Who Can Apply?

Any business entity — whether proprietorship, partnership, LLP, or private limited company — involved in manufacturing or service sectors can register as an MSME if it meets the investment and turnover criteria:

- Micro Enterprise: Investment ≤ ₹1 crore & Turnover ≤ ₹5 crore

- Small Enterprise: Investment ≤ ₹10 crore & Turnover ≤ ₹50 crore

- Medium Enterprise: Investment ≤ ₹50 crore & Turnover ≤ ₹250 crore

Benefits of MSME Registration

- Lower interest rates on loans

- Easy access to government tenders

- Protection against delayed payments

- Subsidies on patent registration and industrial promotion

- Easier loan approvals and credit access

- Preference in government procurement schemes

Submit your Details to get an Instant All-inclusive Quote to your email and a FREE Expert consultation

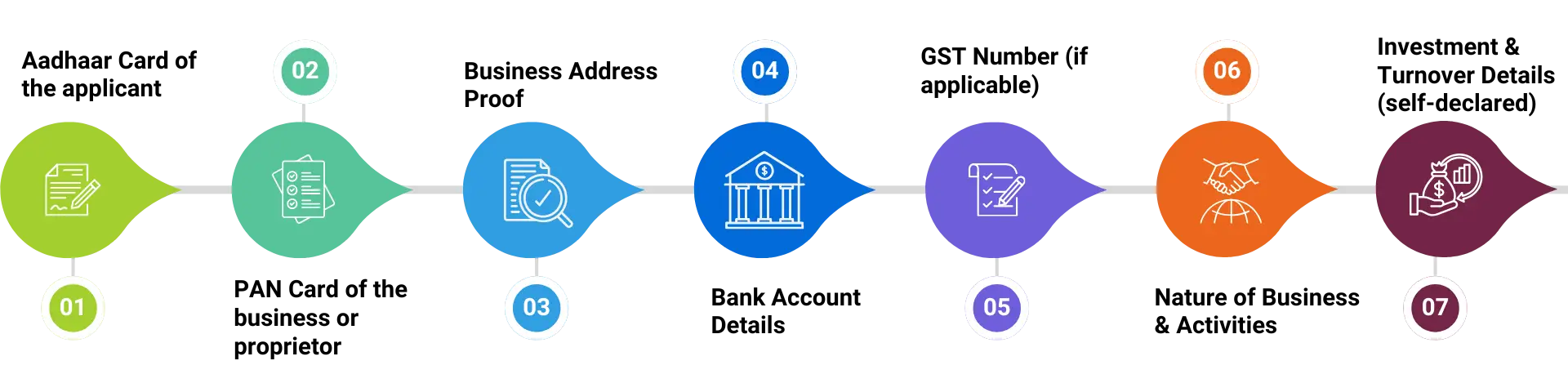

Documents Required for

MSME Registration

MSME Registration Process

Step 1

Step 2

Step 3

Step 4

Step 5

Why Ruchita Dang & Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

#1 company Registration Consultant in India

+91-9250561216

For More Details Contact Us Now!

Frequently Asked Questions

The MSME Registration (Micro, Small, and Medium Enterprises Registration) is an official act under the MSME Act of 2006, that gives recognition and grants access to small enterprises, new ventures, and innovators in India.

Any type of business from a manufacturing or service sector can get MSME Registration including sole-proprietorships, partnerships, LLPs, and private limited companies. Professional MSME Registration Services help to identify the criteria and also support the applicant throughout the entire application procedure.

The businesses that are Registered as MSMEs are entitled to the benefits of the government subsidies, low-interest loans, and credit access that is much easier etc. Professional MSME Registration Services are still there to assist you in getting registered faster and start enjoying these benefits.

The mandatory documents for MSME Registration include Aadhaar card, PAN card, proof of business address, and bank details. An MSME Registration Consultant assists in extracting and correctly uploading all the necessary documents on the Udyam Registration Portal.

Undoubtedly, MSME Registration is not a necessity, yet it is strongly advised to enjoy the financial, legal, and tax benefits that the government is providing. An MSME Registration Consultant can help determine your eligibility.