ITR Filing for Individuals & Companies

File Your Income Tax Return Accurately & On Time with Ruchita Dang & Associates

Every individual and business earning income in India is required to file Income Tax Returns (ITR) under the Income Tax Act, 1961. Whether you're a salaried employee, a freelancer, an entrepreneur, or a company, timely ITR filing is not just a legal obligation but also a vital financial practice that keeps you compliant and benefits you in many ways.

At Ruchita Dang & Associates, we make ITR filing simple, secure, and fully compliant — whether it’s for individuals, startups, SMEs, or large corporations.

What Sets Us Apart

500+ Professionals Network

5000+ All India Clients

2000+ Monthly Clients Onboarded

3500+ Trusted Ratings

Who Needs to File an ITR?

- Salaried employees with income above the basic exemption limit

- Self-employed professionals and freelancers

- Business owners, including sole proprietors and companies

- NRIs with Indian income

- Individuals with foreign assets or bank accounts

- Companies (Private Limited, LLPs, Partnerships, etc.)

Why ITR Filing is Important

- Legal Compliance: Avoid penalties and notices from the Income Tax Department

- Loan & Visa Approvals: Banks and embassies require ITR for credibility

- Claim Refunds: If TDS is deducted, filing ITR helps you claim refunds

- Carry Forward Losses: Offset capital or business losses in future returns

- Avoid Penalties: Late filing may attract penalties up to ₹5,000 or more

Submit your Details to get an Instant All-inclusive Quote to your email and a FREE Expert consultation

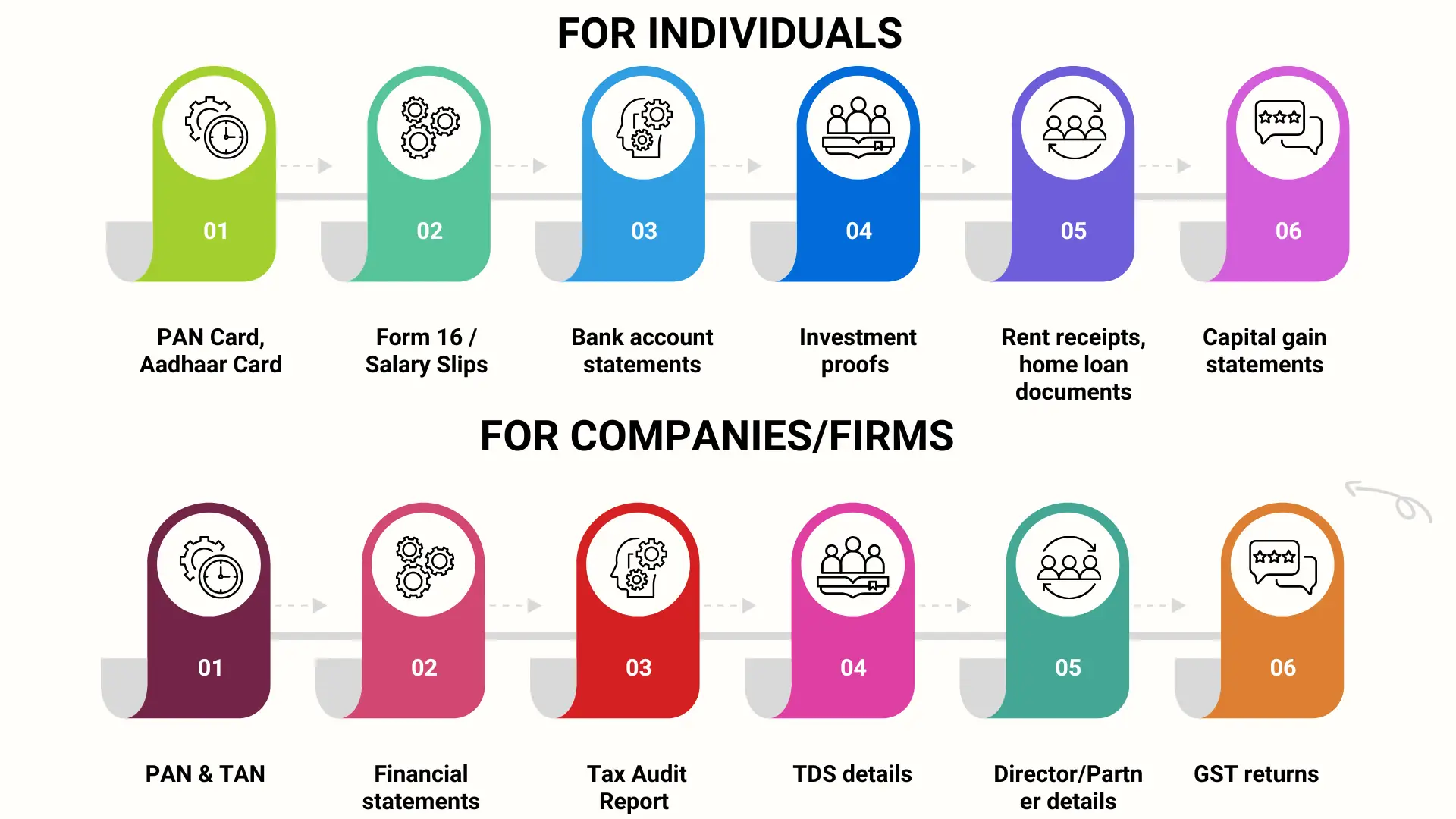

Required Documents for ITR Filing

Why Ruchita Dang & Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

Frequently Asked Questions

Filing ITR for Individuals & Companies means to submit income, expenses, deductions, and taxes paid to the Income Tax Department for each financial year. This process guarantees adherence to tax laws and makes it possible to get refunds or carry forward losses.

The timely filing of Income Tax Returns (ITRs) not only saves filing fees, but it also enables taxpayers to recover tax overpayments and keep up with personal finances. On top of that, companies have more chances for financing, better bids, and easier interactions with government regulators. The Income Tax Consultants are very professional and take care of the whole process.

The documents consist of PAN, Aadhaar, Form 16, financial statements, audit reports (if applicable for companies), TDS certificates, and proofs of investment. The Income Tax Return Filing Service will definitely help you in the accurate preparation and organization of all the documents required for the ITR Filing process.

The due date for individuals is 31st July, while that for companies that need audits is 31st October of the relevant assessment year. Consultants in Income Tax help guarantee that submissions are on time and that no interest or late fees are incurred.

Of course! If you notice a mistake in your tax return filed, you have the option to revise it till the 31st of December of the assessment year. Based on the situation, Professional ITR Filing Services can assist with the changes and filing again.