Income Tax Return Filing

- Our tax experts gather all relevant information to prepare optimized tax returns, ensuring you save money while complying with regulations.

- We offer standardized rates but customized filings based on your investments, income, and declarations.

Source of income

Salary

Business/Profession

House Property

Capital Gains

Other Sources

Income Tax Return (ITR) Filing - Overview

Advantages of Income Tax Returns

(ITR ) Filing

Filing income tax returns offers multiple advantages for a citizen. Here are the top 5 advantages of filing an income tax return in India.

Easy to Claim Tax Refunds

If a taxpayer earns less than ₹5 lakh in a year, they can claim tax refunds that are deducted from their income. It is crucial to file IT returns online by 31 July of every year.

Avoid Legal Consequences

Not filing your income tax returns online in India may result in penalties and legal consequences. The income tax authority may send a notice that carries hefty fines and penalties. It is essential to prevent it by submitting ITR returns on schedule.

Effective for Easy Loan Processing

While applying for a loan or a visa, you should provide your last three years of ITR filing. Submitting the tax returns increases credibility and can help lenders assess your financial status.

ITR Returns Can Act as a Verified Income Statement

Freelancers or other self-employed individuals who don't have an official income statement can use their ITR returns to verify their income.

Process of Income Tax Return Filing

Step 1

1. Consult our tax Experts

Step 2

2. Provide all the Required Documentation

Step 3

3. Get your ITR Filed

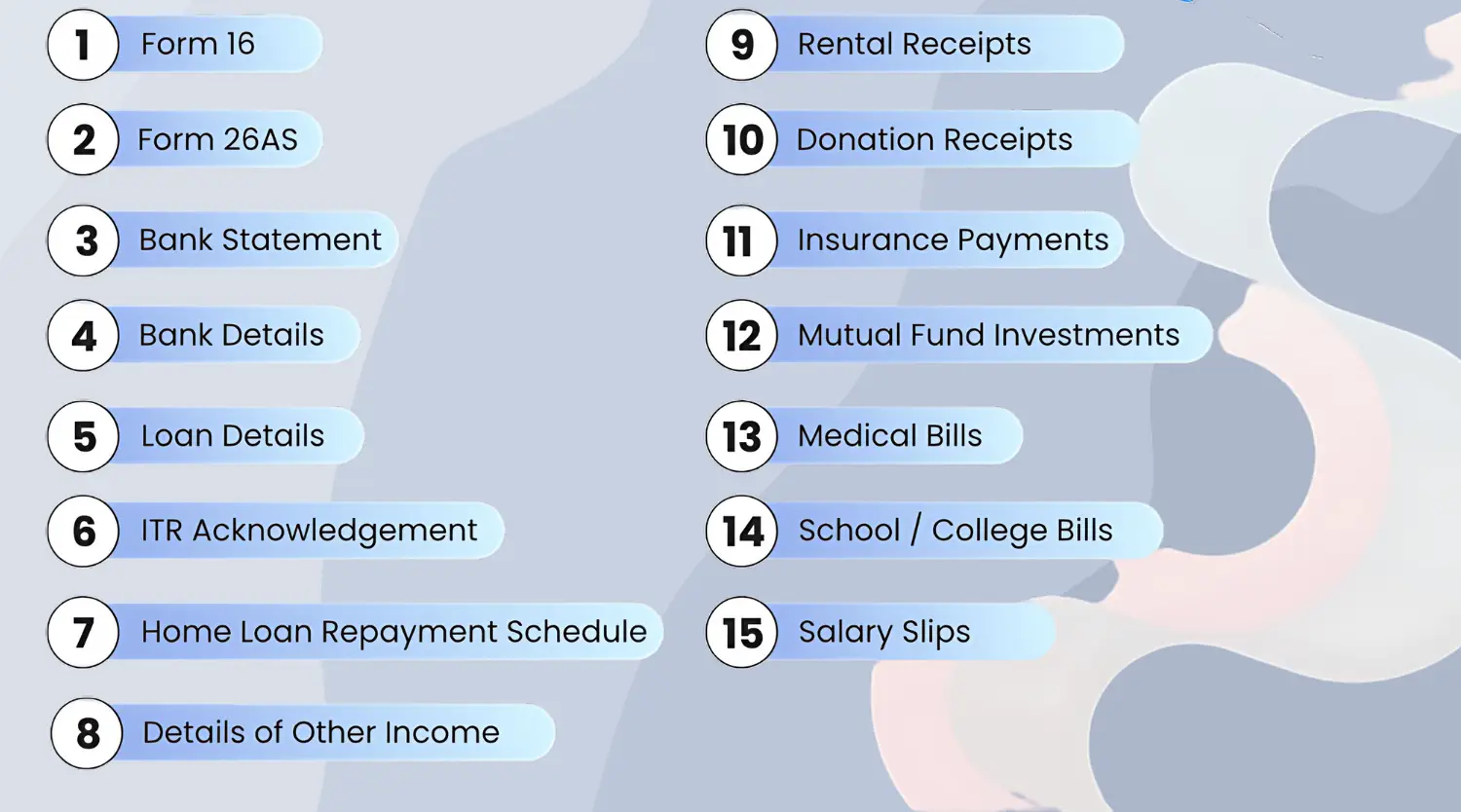

Documents Required to File

Income Tax Return File

Eligibility Criteria for Income Tax Returns (ITR ) Filing

- Salaried individuals whose gross income exceeds the threshold level before considering deductions under Section 80c and Section 80u should file ITR returns

- Entities like private limited companies and limited liability partnerships, irrespective of profit or loss, should file ITR returns

- Individual directors or partners holding positions in private limited companies or limited liability partnerships should file income tax returns online

- Individuals earning dividends from multiple sources like mutual funds, equity, fixed deposits, interests, and bonds should file their ITR online

- Individuals sourcing income from charity, religious trust, or other forms of voluntary contributions should file IT returns

- Businesses and individuals who are eligible for tax refunds should definitely file their income tax returns online

- Non-resident Indians should file an income tax return based on their incomes.

Checklist for Income Tax Returns (ITR ) Filing

Personal Information

Ensure you have your name, address, contact details, and PAN ready.

Identify the Correct ITR Form

Determine the appropriate Income Tax Return (ITR) form based on your income sources and category.

Income Details

Gather all income-related documents, including salary slips, interest income, rental income, and other sources.

Deductions & Exemptions

Keep proofs of deductions under Sections 80C, 80D, 80G, etc., and any applicable exemptions.

TDS, Capital Gains & Foreign Assets

Collect details of TDS certificates (Form 16/16A), capital gains statements, and any foreign income or assets.

For Firms/Companies

Keep financial statements, audit reports, TDS compliance documents, and related party transaction records.

Annual Compliances

Ensure availability of documents related to annual filings, ROC returns, and other statutory compliances.

Why Should You File ITR?

As per the income tax laws, every citizen who is earning income should file an income tax return if their total income exceeds the basic threshold. Online ITR return filing helps you carry forward the losses in the present year to the next financial year.

Filing ITR returns online creates a valid proof of income. It is mandatory for applying for any loans in the future; filing ITR returns is required for applying for credit cards in the future. It is valid proof when it comes to visa applications.

Mandatory E-filing for Individuals

Filing income tax return in India is mandatory for individuals under the following circumstances:

- Individuals below 60 years with gross total income exceeding ₹2.5 lakh

- Individuals aged 60–80 years with gross total income exceeding ₹3 lakh

- Individuals above 80 years with gross total income exceeding ₹5 lakh

Other Conditions Requiring Mandatory ITR Filing:

- Cash deposits over ₹1 crore in a current bank account

- Deposits over ₹50 lakh in a savings bank account

- Foreign travel expenses exceeding ₹2 lakh

- Electricity expenses over ₹1 lakh in a year

- TCS or TDS of ₹25,000 or more (₹50,000 for senior citizens)

- Business turnover above ₹60 lakh

- Professional income exceeding ₹10 lakh

FAQs on Filing ITR online

Get answers to the most common questions about Income Tax Return Filling

Income Tax Return Filing refers to the process of reporting to the Income Tax Department your income, the tax deductions you might have had, and the tax payments you made during the year. It is a necessary step in ascertaining your tax liability or refund eligibility for the concerned financial year.

Income Tax Return Filing is mandatory for every individual, company, or firm, whose income is subject to tax. However, those whose income is below the taxable limit and choose to file can get their taxes refunded or their records kept up-to-date. Moreover, ITR Filing Services are professional and assure that the filing is done accurately and timely.

The filing of your Income Tax Return will allow you to claim tax refunds, loan applications, and legal compliance maintenance. It acts as proof of income and also helps you to escape fines. Expert ITR Filing Services are your guarantee for maximum deductions and benefits.

The most often used documents are PAN, Aadhaar, Form 16, bank statements, TDS certificates, and investment proofs. Not only does an Income Tax Consultant assist you in gathering the required documents but they also ensure your return is filed correctly according to your specific income source.

In case you realize mistakes after submitting the return, you will be able to change your Income Tax Return up to the 31st of December of the respective assessment year. To be on the safe side, an Income Tax Consultant can perfectly guide you through the process of making the amendments and submitting the return again.