Annual Compliance of LLP

Stay Compliant, Stay Stress-Free with Ruchita Dang & Associates!

A Limited Liability Partnership (LLP) is a popular business structure in India that combines the advantages of a company and a partnership. However, even though LLPs enjoy fewer compliance obligations than private companies, they are still mandated to file specific annual returns and financial statements with the Ministry of Corporate Affairs (MCA) every year—regardless of turnover. At Ruchita Dang & Associates, we make sure your LLP stays fully compliant by handling all filings professionally, on time, and with minimal involvement from your side

What is Annual Compliance for an LLP?

Annual compliance refers to a set of mandatory filings that all LLPs registered under the LLP Act, 2008 must fulfill to maintain their active legal status. Even if the LLP has not done any business during the year, it must still file the required forms.

Submit your Details to get an Instant All-inclusive Quote to your email and a FREE Expert consultation

Have queries? Reach out to

our experts.

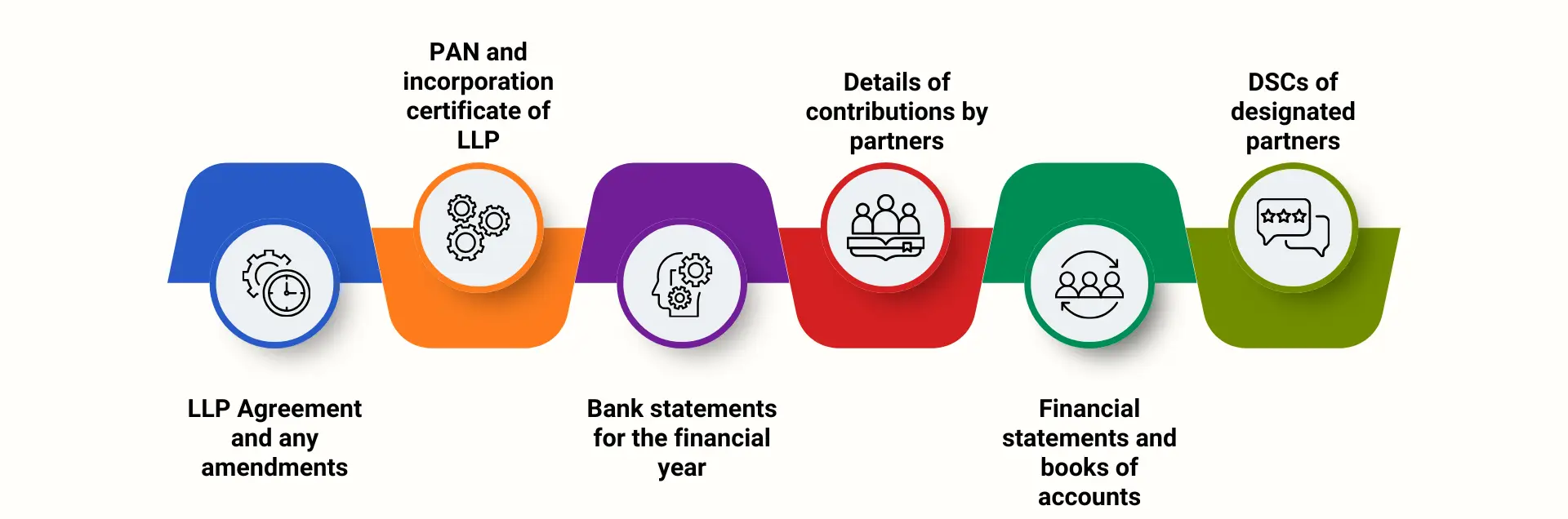

Documents Required

Key Annual Compliances for LLPs

- Form 11 – Annual Return

- Due Date: 30th May every year

- Contains basic details of the LLP and its partners.

- Required even if LLP has no business activity.

- Form 8 – Statement of Accounts & Solvency

- Due Date: 30th October every year

- A declaration on solvency and statement of profit/loss & assets/liabilities.

- Income Tax Return Filing

- Due Date: 31st July (non-audit) / 31st October (audit cases)

- Filed with the Income Tax Department depending on turnover and audit requirements.

- Audit of Accounts (If applicable)

- If turnover exceeds ₹40 lakhs or contribution exceeds ₹25 lakhs, accounts must be audited by a Chartered Accountant.

Registration Process

Step 1

Step 2

Step 3

Step 4

Step 5

Why Ruchita Dang & Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

Frequently Asked Questions

Annual Compliance of LLP is the term for the necessary filings and reports that every Limited Liability Partnership has to submit every financial year in order to keep its legal status. These are the filings of Form 8 (Statement of Accounts & Solvency) and Form 11 (Annual Return).

On the other hand, the other way of Annual Compliance of LLP filing is that it keeps your LLP in good standing with the Ministry of Corporate Affairs (MCA). Non-compliance can result in a significant amount of penalties and the removal of designated partners. Professional LLP Annual Compliance Services are there to help you eliminate such risks.c

An LLP has to file two main forms every year:

- Form 11 – Annual Return within 60 days from the end of the financial year.

- Form 8 – Statement of Accounts & Solvency within 30 days from the end of the financial year, plus six months.

A professional LLP Compliance Consultant duly ensures these forms are submitted correctly and on time.

Documents required include financial statements, partner details, income tax returns, and proof of solvency. Reliable LLP Annual Compliance Services help prepare and verify all these documents to meet MCA standards.

In the case of Annual Compliance of LLP not being filed, a daily penalty of ₹100 per form can be imposed without any ceiling until the forms are filed. A LLP Compliance Consultant is a good idea for you to stay compliant and avoid such penalties.

No, in case the LLP has no business activity or income, it is still required to file Annual Compliance of LLP every year. Professional LLP Annual Compliance Services will assist you in filing nil returns in order to keep your company’s legal status active.

A competent LLP Compliance Consultant takes care of the paperwork, makes the financial statements, sees to it that everything is filed on time, and gives advice on tax and compliance matters which—makes your life easier and avoids you legal problems.