Annual Compliance of LLP

Stay Legally Compliant with Expert-Led LLP Annual Filings

At Ruchita Dang & Associates, we make sure your LLP meets all its annual compliance obligations smoothly and on time. Annual compliance is mandatory for all Limited Liability Partnerships registered under the LLP Act, 2008—whether operational or inactive. Neglecting these filings can lead to hefty penalties, legal consequences, and even disqualification of designated partners. Let us help you avoid all of that with expert guidance, timely filings, and end-to-end support.

What Sets Us Apart

500+ Professionals Network

5000+ All India Clients

2000+ Monthly Clients Onboarded

3500+ Trusted Ratings

What is LLP Annual Compliance?

LLPs in India are required to file two major annual returns every financial year:

Form 11 – Annual Return

Must be filed within 60 days from the end of the financial year (i.e., by 30th May).Form 8 – Statement of Account & Solvency

Must be filed by 30th October every year, declaring the financial position of the LLP.

Additionally, LLPs with a turnover of more than ₹40 lakhs or contribution over ₹25 lakhs must get their accounts audited by a Chartered Accountant.

Important Due Dates

Submit your Details to get an Instant All-inclusive Quote to your email and a FREE Expert consultation

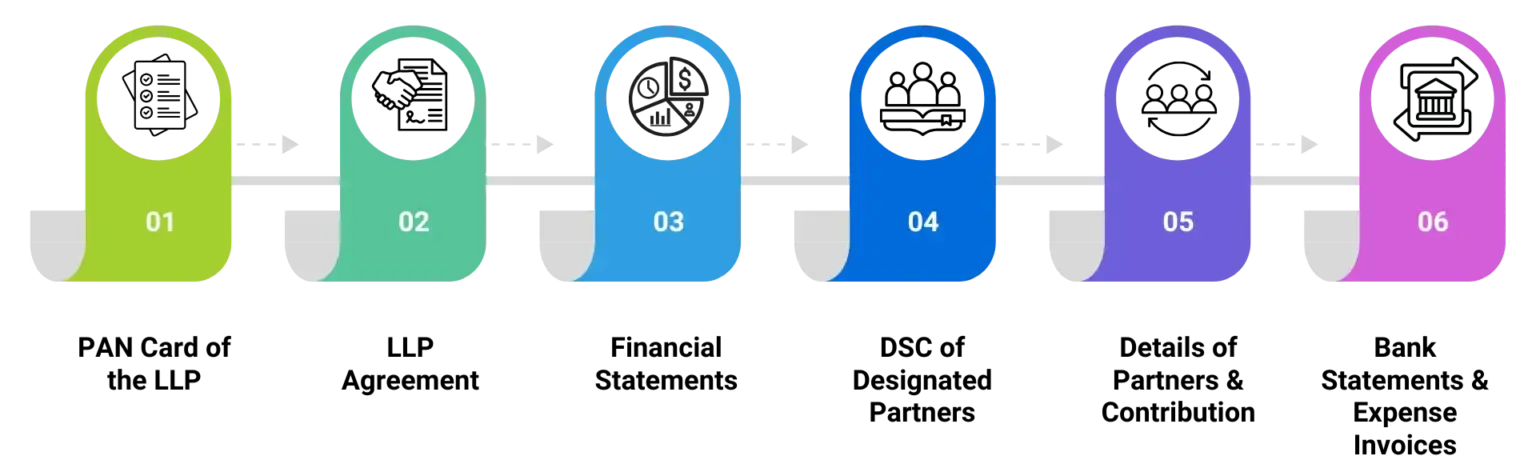

Documents Required

Our Process

Step 1

Step 2

Step 3

Step 4

Why Ruchita Dang & Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

Frequently Asked Questions

The Annual Compliance of a Private Limited Company stand for the compulsory filings, documentations, and disclosures that each company registered under the Companies Act, 2013 has to do every financial year to keep its legal status.

The need for Annual Compliance by a Private Limited Company assures that the company has a legal and clear image with the authorities and also has smooth business operations. Sometimes, directors may face disqualification and fines as a result of non-compliance. Companies providing Professional Private Limited Company Annual Compliance Services will help in compliance.

All the companies are obliged to submit:

- Form AOC-4 – Financial Statements,

- Form MGT-7 – Annual Return,

- Form ADT-1 – Auditor Appointment, and

A well-versed Private Limited Company Compliance Consultant takes care of the filings being done on time and accurately.

The documents include: audited financial statements, the Board of Directors’ report, shareholding details, and auditor information. The Expert Private Limited Company Annual Compliance Services help in getting together and checking these documents so that they are in line with the MCA norms.

Normally, the Annual Compliance filings are carried out for Private Limited Companies within a span of 30 to 45 days after the financial year-end, and this depends on the difficulty of the financial statements and the approval of the auditors. The use of Professional Annual Compliance Services guarantees that everything is done on time.