Accounts & Audit Services

Accurate. Compliant. Insightful.

At Ruchita Dang & Associates, we understand that proper accounting and timely auditing are not just compliance requirements—they are the foundation of informed decision-making and financial stability. Our expert team of Chartered Accountants, CS, and financial advisors deliver end-to-end accounting and audit solutions for businesses of all sizes and sectors.

What Sets Us Apart

500+ Professionals Network

5000+ All India Clients

2000+ Monthly Clients Onboarded

3500+ Trusted Ratings

What are Accounts & Audit Services?

Accounts and Audit Services refer to the professional processes involved in maintaining, analyzing, verifying, and reporting a company’s financial records and performance. These services are crucial for ensuring regulatory compliance, financial transparency, and effective business decision-making.

Accounts Services

These involve the systematic recording of financial transactions and the preparation of financial statements like:

- Profit & Loss Account

- Balance Sheet

- Cash Flow Statement

Important Due Dates

Bookkeeping & Ledger Maintenance

Ensure real-time and accurate recording of financial transactions using Tally, Zoho, QuickBooks, or your ERP.

Preparation of Financial Statements

Profit & Loss, Balance Sheet, and Cash Flow Statements, compliant with statutory and industry norms.

Accounts Reconciliation

Bank, vendor, customer, and inter-company reconciliation services to ensure accuracy and reduce risk.

Payroll Processing & Statutory Compliance

Timely salary processing, TDS, PF, ESI, and return filings.

GST Accounting & Filing Support

Monthly/quarterly reconciliation and return preparation, along with audit assistance.

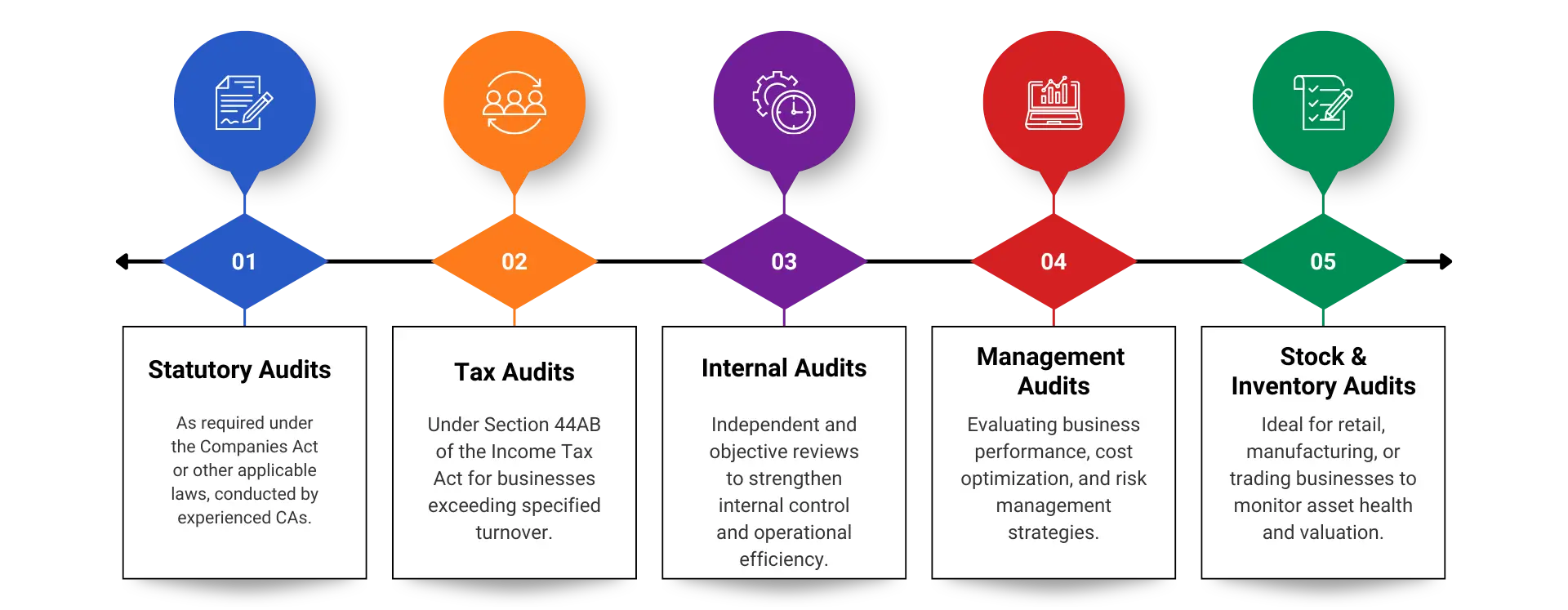

Audit Services We Offer:

Our Process for Accounts &

Audit Services

At Ruchita Dang & Associates, we follow a streamlined and transparent process to ensure your business remains compliant,

financially sound, and audit-ready at all times.

Step 1

Step 2

Step 3

Step 4

Step 5

Step 6

Why Ruchita Dang & Associates

250+ Experts

4.5* Google Rating

24/7 Assistance

Quick and Easy Process

Complete Online Process

#1 company Registration Consultant in India

+91-9250561216

For More Details Contact Us Now!

Frequently Asked Questions

Accounts and Audit Services are professional financial solutions that comprise the bookkeeping, the preparation of financial statements, the conducting of internal audits and statutory audits, and the performing of compliance checks that are all aimed at a business’s financial accuracy and legal compliance.

The main advantage of Accounts and Audit Services is that they provide a transparent picture of the business, help keep the business within the law, uncover mistakes or fraud, and offer ways to make the business financially healthier. Moreover, they win the trust of investors, banks, and government agencies.

With tax authorities and other stakeholders requiring diligence and transparency from companies, frequent types of Statutory Audit, Internal Audit, Tax Audit, and Management Audit are done. Professional Accounting and Auditing Services in India guide firms in selecting and executing the proper audit type according to business needs.

Only those with the proper credentials like Chartered Accountants (CAs) or certified Accounts and Audit Consultants are allowed to perform audits and prepare financial statements according to Indian regulations.

The audit basics include financial statements, bank statements, invoices, receipts, purchase records, and ledgers. An Accounts and Audit Consultant provides support in preparing and organizing all records to ensure the audit process goes smoothly.